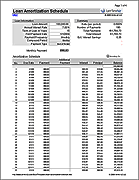

Mortgage Calculator Excel Spreadsheet Loan Amortization Table

Microsoft Excel Mortgage Calculator with Amortization Schedule. How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule & Extra. Amortization Schedule Calculator Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest.

Auto Loan Amortization Excel Spreadsheet

Are you a student? Did you know that Amazon is offering 6 months of Amazon Prime - free two-day shipping, free movies, and other benefits - to students? This is the first of a two-part tutorial on amortization schedules. In this tutorial we will see how to create an amortization schedule for a fixed-rate loan using Microsoft Excel and other spreadsheets (the next part shows and also includes a sample spreadsheet using this same example data). Almost all of this tutorial also applies to virtually all other spreadsheet programs such as.

Spreadsheets have many advantages over financial calculators for this purpose, including flexibility, ease of use, and formatting capabilities. You can download the or follow the example and create your own. Fully amortizing loans are quite common. Examples include home mortgages, car loans, etc. Typically, but not always, a fully amortizing loan is one that calls for equal payments throughout the life of the loan.

The loan balance is fully retired after the last payment is made. Each payment in this type of loan consists of interest and principal payments. It is the presence of the principal payment that slowly reduces the loan balance, eventually to $0. If extra principal payments are made, then the remaining balance will decline more quickly than the loan contract originally anticipated. An amortization schedule is a table that shows each loan payment and a breakdown of the amount of interest and principal. Typically, it will also show the remaining balance after each payment has been made. Calculating Interest and Principal in a Single Payment Let's start by reviewing the basics with an example loan (if you already know the basics, you can skip right to ): Imagine that you are about to take out a 30-year fixed-rate mortgage.

The terms of the loan specify an initial principal balance (the amount borrowed) of $200,000 and an APR of 6.75%. Payments will be made monthly. What will be the monthly payment? Kinesis corporation ac210musb-wht kinesis low-force keypad for mac download. How much of the first payment will be interest, and how much will be principal?

Our first priority is to calculate the monthly payment amount. We can do this most easily by using Excel's PMT function. Note that since we are making monthly payments, we will need to adjust the number of periods (NPer) and the interest rate (Rate) to monthly values. We will do this within the PMT function itself. Open a new spreadsheet and enter the data as shown below: Recall that the PMT function is defined as: PMT(Rate,NPer,PV, FV, Type) where Rate is the per period interest rate and NPer is the total number of periods. In this case, as shown in the picture, we calculate the Rate with B4/B5 (0.5625% per month), and NPer is B3.B5 (360 months).

PV is entered as -B2 (-200,000, negative because we want the answer to be a positive number). You can see that the monthly payment is $1,297.20.

(Note that your actual mortgage payment would be higher because it would likely include insurance and property tax payments that would be funneled into an escrow account by the mortgage service company.) That answers our first question. So, we now need to separate that payment into its interest and principal components.